Use Tax Part 2: Vendor Assessed Taxes Method 2

This is the second way one could handle vendor assessed taxes. In this example, the vendor has assessed sales tax on you. The vendors’ invoice is $100 for goods/services and they have charged an additional $10 for sales tax; making the liability to the vendor = $110. The tax is not in error and is the correct amount more or less, and you are not self-assessing this tax.

Setups

Application of a Discount:

If you do not want tax to be included in early pay discounts, i.e. a term like 210N30, the 2% is only on the $100 and not on the $10.

1) In Business Central, go to General Ledger Setup

2) Toggle on the Pmt. Disc. Excl Tax; note you can not combined Adjust for Payment Disc. At the same time, this one must be turned off.

3) Be sure to also select a Max. Tax Difference Allowed – this will allow you to make updates to the tax on an individual invoice if the vendor charges you something slightly different.

If you do want tax to be included in early pay discounts, i.e. a term like 210N30, the 2% is taken off the amount and the tax is re-calculated based on the new amount ($98).

1) In Business Central, go to General Ledger Setup

2) Toggle on the Adjust for Payment Disc.; note you can not combined Adjust for Pmt. Disc. Ecl Tax at the same time, this one must be turned off.

3) Be sure to also select a Max. Tax Difference Allowed – this will allow you to make updates to the tax on an individual invoice if the vendor charges you something slightly different.

Purchase & Payables

1) In Purchases & Payable Setup ensure that the Allow Tax Difference is True/on. Calc. Inv. Discount should also be turned on.

2) Make sure “Use Vendor's Tax Area Code” is turned to TRUE. This will ensure the tax area code gets pulled from the vendor card onto the purchase document.

Tax Setups

1) In Business Central it’s best to setup a new group that’s different if it’s vendor imposed tax. Such as Vendor or Supplies.

2) Under Tax Details, you would add a line for each tax jurisdiction, that you would use Use Tax, that’s a combo of the Jurisdiction and the new Tax Group Code. You would select the tax amount in Tax Below Maximum, and then you would checkmark the Expense column. Typically, this should be turned off for self-assessed use tax or sales tax.

Using Use Tax

1) On a purchase document (order or invoice), under the Invoice Details fasttab

a. Tax Liable = TRUE

b. Tax Area Code = Where the vendor has charged you tax.

2) Enter the lines like normal; however, change the Tax Group Code = VENDOR (or supplies) for the lines the vendor has charged you tax. Use Tax should = FALSE

3) You should see the Total Tax updating and the Total Tax= Amount on Invoice and the Total Incl. Tax should equal to what the invoice shows due to the Vendor. If not see instructions below.

4) If these do match or once they do match, post or carry on like normal.

5) Pay the invoice like normal, if early pay discounts are applied it will use the setting in General Ledger to determine if tax is included or not for early pay.

How the GL is impacted:

1) The AP (22100) amount due is the amount on Total Inc. Tax

2) The Tax follows the item or GL account as a mark up of the Item (14130 COGS) or GL Account (64100). Note in the screenshot 14140 is Direct Cost Applied and is in and out as expected for the item.

Fixing Incorrectly Calculated Tax

If the Vendor has charged you a different amount, such as they didn’t stop at the Fargo threshold of $2,500 city tax

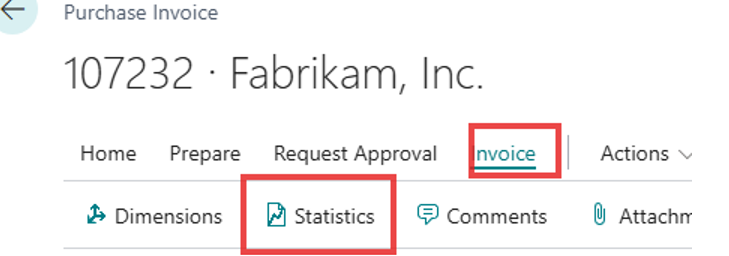

1) On the purchase document, under Invoice >> Statistics

2) On the Tax Amount you can adjust the tax per Tax Jurisdiction Code to match with the vendors invoice. Note: you can only adjust to the amount on the Max Tax Difference on the General Ledger Setup.