Use Tax Part 3: Self Assessing Use Tax

Disclaimer: This is suggestions and best use of how one might document sales tax imposed and/or accrue use tax. This is not legal or financial advice. If you are legally obligated to collect/remit use tax and when you are obligated to do so you should consult with your city/county/parish or a SALT expert.

This assumes are using Use Tax in Business Central. As well, the assumption is you are remitting this amount back to the State and not to the vendor. I.e. the vendor has charged you $100 for the Item and $0 for Tax, and we will accrue $10 of tax and remit that to the state because the vendor should have charged us tax. If the vendor has charged you $100 for an item and $10 for tax do not use the below requirements.

Note: I am making an assumption that you know how to configure the sales tax module. If you don’t the rest may be confusing.

Just like in Vendor Assessed sales tax you can also do a in/out line in BC to accrue tax. This is a simple way to accrue it on a purchase document which would look similar if you did an after the fact general journal to accrue it. However, I do recommend you do use the use tax module to accrue tax instead.

Setups

See Part 2 for some basic setups on General Ledger and Purchases & Payables for discounts, use on vendor card, and rounding.

Otherwise, for Use Tax self-assessment using the Sales Tax Modules such as Tax Jurisdiction, Tax Area, etc is the same and you would utilize the same tax codes you do for sales tax such as Taxable or Nontaxable. Though, I have seen additional categories such as “Supplies” to make it clear this was for use tax; more so if use tax rates are different then your sales tax rate for your office/warehouse.

Using

1) In Business Central on a purchase document (order or Invoice)

2) Under Invoice Details, Tax Liable = TRUE; Tax Area Code should be set to what tax authority you are assessing tax for (normally this is your facility location’s tax code).

3) Add the Item or G/L Account line like normal including the Direct Unit Cost Excl. Tax.

a. Tax Group Code: TAXABLE if this item/service needs tax on it, if this is something that’s not taxable, use Nontaxable.

b. Use Tax: TRUE

4) You’ll see that Total Tax updated.

5) If you were to review the transactions/GL entries we’d see

a. The expense side follows the expense account. I.e. we used Office Supplies, so the expense side follows the office supplies.

b. We have a self assessment of Fargo, Country and State tax broken up going to the sales tax payable account

c. The vendors invoice is only for the $750 and not the amount of tax

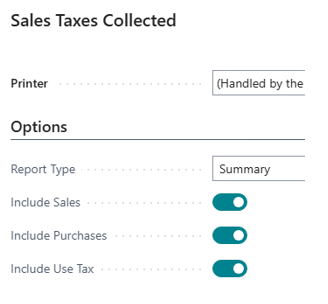

6) The amount of the tax can be viewed by running the Sales Tax Collected Report, ensuring to select Purchase Tax

7) You can add a Tax Group Code to GL Account cards for expenses to simplify the process.

8) You can find rates under the Tax Details section of BC. Though it is the Tax Area (where rates combined) that is on vendors.